- +1 281.389.0771

- info@olgess.net

-

Mon - Fri: 8:00 - 17:00 / Closed on Weekends

Products & Services

for Salt Cavern

Brine Production: In this case, caverns are a by-product of brine

production. As brine is produced, a cavern is created and enlarged.

Brine can be sold for use in drilling fluids for drilling oil and gas wells

or can be used to make salt or other chemicals. Once caverns have reached

their maximum permitted size or can no longer be operated efficiently, brine

production stops, and the caverns are either left filled with brine or are

used for other purposes, such as storage or disposal.

Hydrocarbon Storage: Salt caverns have been used to store various types of

hydrocarbons since the 1940s. The types of products that have been stored in

these caverns include liquefied petroleum gas (LPG), propane, butane,

ethane, ethylene, fuel oil, gasoline, natural gas, and crude oil.

The largest

underground storage operations in the United States are part of the U.S.

Department of Energy's

(DOE's)

Strategic Petroleum Reserve (SPR). The SPR currently stores about 560

million barrels of crude oil in 62 caverns located at four sites in

Louisiana and Texas.

Efforts are underway to add another 28 million barrels of crude oil to these

sites.

Waste Disposal: Salt caverns represent secure repositories located far below

the earth's

surface. Several proposals have been made in the United States, Mexico, and

Europe to dispose of hazardous chemical wastes in salt caverns, but as of

1999, none have received regulatory approval. In the United States, the DOE,

after years of careful study, opened its Waste Isolation Pilot Plant (WIPP),

in a bedded salt formation in New Mexico. Although the WIPP was created

through conventional mining techniques rather than through solution mining,

DOE's

decision to place a nuclear waste disposal facility in bedded salt is an

indication of the protection offered by salt formations.

Clean Energy Storage: Energy captured at off-peak times can be stored as

compressed air and released when pricing is higher.

Caverns #11 and #111 are unused and have capacity of approximately 650,000

barrels of material. The site also includes a salt water disposal well that

has been used for brine disposal from cavern creation and produced water

disposal from oilfield operations.

A compelling feature of this site is the optionality associated with it, and the factors that mitigate risk associated with investment in the site.

1.The NewCo facility was previously operated as a disposal site. The

property owner Funderburk Underground Storage, Inc. formerly leased the site

to an outside operator. It is equipped with truck receiving, offloading, and

fluid storage. The saltwater/brine disposal well used by the operator has

undergone a workover which has it ready for significant continued use.

2.Two caverns remain that are suitable for disposal of (NOW) having an

estimated 675,000 bbl.'s

of cavern space currently.

3.These same caverns are astride of a Natural Gas pipeline, a Volatile

liquids pipeline and adjacent to or near to a number of petroleum product

systems and pipelines. At present, a number of companies operate wells in

the area.

4.The productive strata in the area include conventional oil (Woodbine,

Austin Chalk) and unconventional Eaglebine conventional gas (Cotton Valley &

others) Barnett Shale, Haynesvilte Shale, and Bossier Shale plays. Along

with the Eaglebine, Lower Cretaceous zones below the Eaglebine - the Buda,

Georgetown, Edwards, and Glen Rose - are also known to have significant oil

potential in the area.

5.The site is well positioned near what can be the largest NORM

accumulations in the world. The genesis of this statement comes from the

fact that NORM accumulations in tubulars, wellheads, vessels, and pipelines

has a direct relationship with high chloride content in reservoirs,

fracking, and increases with the amount of time the reservoir has been

produced.

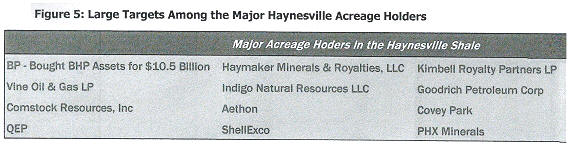

Figure 5 (below) lists larger companies with Haynesville acreage that are

logical customers for disposal of produced water, drilling mud, and cuttings

and a lot of NORM.

For Natural

Gas prices, it was business, as usual, for much of 2020, with Henry Hub spot

prices swinging wildly, dropping to a yearly low of $1.33/MMBtu, before

rebounding sharply to $3.14/MMBtu during the week of Oct. 26-30, and rising

as high as $3.67 the week of July 19 this year according to [IA data. That

is an increase of 275% from the low of 2020.

36 drilling rigs are operating in Northern Louisiana this week and 17 rigs

in East Texas Districts 5 & 6 amount to just over 12% % of all rigs

operating in America